RECOMMENDATION TO IMPROVE NEGATIVE CASH BUDGET

Encourage customers to pay you early by offering discounts. The cash budget can also be used to help prepare the budgeted statement of financial position part of the companys master budget.

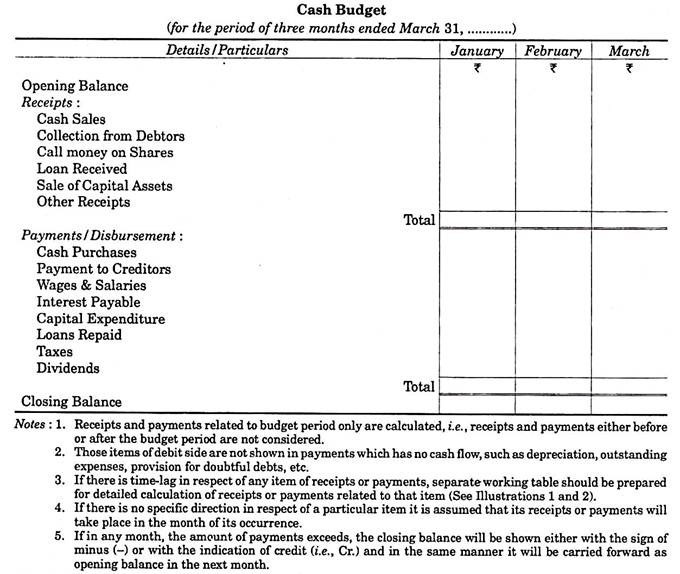

Cash Budget Methods 3 Methods Of Preparing A Cash Budget

Send reminders and collection letters.

. This will help your budget remain. Has a lowest cash balance of 1200 at the end of April following the loan repayment in the same month. Review outgoing expenses.

To improve negative cash flow try shortening your current payment terms. The same firm may use accrual accounting for financial reporting as well but leaders probably refer first to this cash budget when dealing with cash flow issues. Your operating budget is your measurement tool for success.

Revenues and expenses do not appear here until their cash flows occur. The Uses of Cash section contains all planned cash expenditures which comes from the direct materials. A cash budget is a document produced to help a business manage their cash flow.

Balance the assessment of your customers creditworthiness to protect your business from being vulnerable to negative cash flow and bad debts. Increasing your customer demand by changing your product or increasing your marketing budget. The key is to have a vision of what you want to achieve where you want to go and what you want the business to become.

Better than expected result. Adjusting your budget to be more realistic. Your budget is used to drive pricing and profitability.

Develop a long-term strategy. You can improve your business by increasing your profits reducing losses getting more customers expanding the markets becoming more visible in the community going public or a number of other items deemed desirable. The cash budget is comprised of two main areas which are Sources of Cash and Uses of Cash.

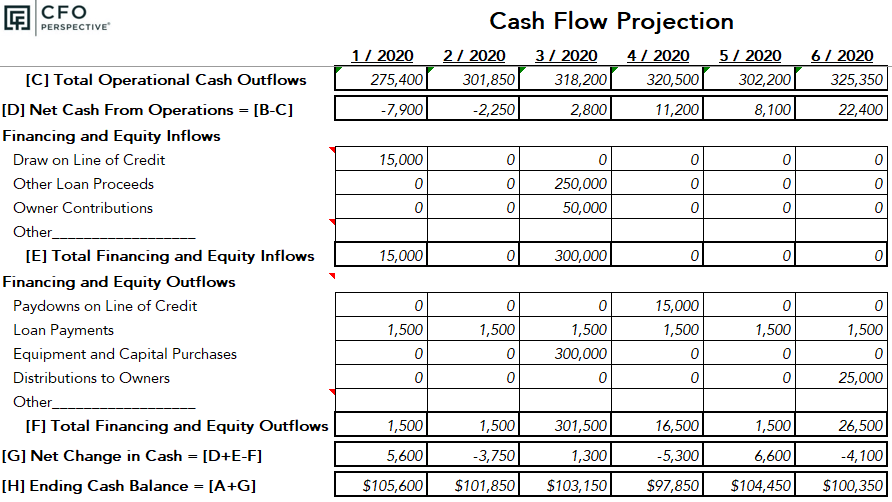

The goal is to maintain sufficient cash for firm operations from month to month. 6 Establish penalty for late payments As much as you incentivize timely fulfillment of payment obligations you also have to establish a penalty for late-paying customers. Determine whether you have a loss from your.

A cash flow analysis is a method of checking up on your firms financial health. You can also use a business credit card as some offer a grace period as long as 21 days which can do a lot to increase your cash flow. POSITIVE VARIANCESIMPACTS anything that boosts profits.

Adjusting your process to be less wasteful and more efficient and effective. A cash budget is prepared in advance and shows all the planned monthly cash incomings receipts and. The cash budget shows actual cash inflows and outflows in the period they occur.

Look at the source. Cash flow measures all expenses that go in and out of your. However improving cash-flow can have a number of benefits including.

First find out why your cash flow is negative. To make up. Efforts to create a national system of industrial assistance to improve the manufacturing performance of smaller companies should recognize the importance of creating a coherent system and not just increasing the number of assistance facilities and service providers.

Take a look at your operating and overhead expenses. Create a cash flow statement and forecast regularly. Not all variances are bad things some can actually be good.

The cash flow budget indicates that XYZ can continue trading for the next six months without recourse to additional funding. Follow your budget strictly and only go outside of it when it is beneficial to your business generating more money or keeping more money. The trick at this point is that for budgeting purposes it is important to consider the budget variance in terms of how it has impacted profits.

We already know that the cash balance is budgeted to be 94000 at the end of the first quarters trading but the metal box company can also calculate the material inventory trade receivables and trade. The idea is that if you allocate 50 of your income to essentials like housing bills food 30 to personal expenses like eating out travel personal care items and 20 to savings you will automatically limit major expenses while still saving enough to be financially secure. Recommendation Cash Flow Improvement Program.

Lack of Operating Budgets You need a budget that is realistic and meaningful. The Sources of Cash section contains the beginning cash balance as well as cash receipts from cash sales accounts receivable collections and the sale of assets. In todays ever changing environment you may need several variations of your budget.

5 tips to manage negative cash flow 1. Managing negative cash flow 1. Your budget also needs to be revisited quarterly if not monthly.

Be mindful of your spending and investing. This buying of time improves your cash flow. You set invoice payment terms with your customers so they know when to pay you.

Outdated Systems and Processes Proper systems and. A very Key Point to consider here. Cut expenses One reason for negative cash flow is that you have too many costs.

Before splurging on new equipment software or employees weigh your. It is the study of the movement of cash through your business called a cash budget to determine patterns of how you take in and pay out money. Reconsidering your projected revenue by changing your prices volumes or sales process.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

How To Manage Cash Flow In Small Business Tips Solutions

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

Cash Flow Statement Analyzing Financing Activities

Difference Between Master Budget And Cash Budget Compare The Difference Between Similar Terms

Negative Cash Flow Investments In Companies

Negative Cash Flow Investments In Companies

10 Ways To Improve Cash Flow For Your Business

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

Cash Flow Statement Analyzing Financing Activities

How To Conquer Cash Flow Chaos With This Excel Cash Flow Projection Template Cfo Perspective

Belum ada Komentar untuk "RECOMMENDATION TO IMPROVE NEGATIVE CASH BUDGET"

Posting Komentar